is there a tax on death

The income tax treatment is the same as that described in subparagraph 1c above. Even if two persons in every village had died due to Covid a gross underestimate that will out deaths at 1000000.

Some states also apply an inheritance tax in which the beneficiary could also be taxed after.

. Posted on January 24 2022 by Trust Estate Loans. Federal capital gains possible state capital gains and federal estate. The spouse may exclude from income the same dollar amount or.

4 hours agoCounting death poverty and taxes. Fortunately these taxes are almost a thing of the past. Death taxes are taxes imposed by the federal andor state government on someones estate upon their death.

Tax Considerations of Inherited 401ks. More information is available in the Form 1040 or 1040-SR Instructions in Publication 17 Your Federal Income Tax and in IRS Publication 559 Survivors Executors and Administrators. Federal estate taxes and in a few states state estate taxes apply before your property is transferred.

Since the passage of California Proposition 19 more and more families are receiving notices that the death of a parent has triggered reassessment of a family property and sharply increased their property tax bill. Some death benefits purchased through a pension plan function similarly to life insurance which means theyre only taxable if the payout amount exceeds the purchase price. Dying may get you out of a lot of things but not taxes.

After all dead people arent getting any more services from government. Repealing Californias Death Tax. But one tax that comes about as close as possible to being theft is the estate tax.

The tax in these states ranges from 0 to 18. The federal estate tax exemption is 1206 million as of 2022 so this might not be a concern for most taxpayers. Youll have to pay taxes on any distributions taken out of the account at current income tax rates.

They are taxed at the applicable capital gains tax rates. If the decedent has not done so you. The beneficiary who receives the inheritance has to pay the tax.

However tax may be due on any interest earned by the death benefit. 2286 Pascrell and a proposal by Senators Van Hollen Booker Sanders Warren and Whitehouse not yet introduced as legislation would tax capital gains at death with an exemption for the first 1 million of gain. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

If you have a lot of property you want to leave to your children or other heirs it may be subject to taxation. File the return using Form 1040 or 1040-SR or if the decedent qualifies one of the simpler forms in the 1040 series Forms 1040 or 1040-SR A. Spouses are exempt from inheritance taxation while children can be exempt or pay a minimal amount.

If the payout does exceed the original purchase price only. Interest accrues on the funds during the delay and that interest is taxable when the funds are eventually paid out. Tax-wise the new IRA recipient is subject to the same tax rules that any IRA holder would be.

This includes both the Federal estate tax and state inheritance taxes. The Estate Tax is a tax on your right to transfer property at your death. The death tax is any tax levied on property and assets being transferred from the estate of a deceased person.

There were 664369 villages in India in 2019. The surviving spouse pension is subject to the same federal income tax treatment as the IMRF retired members pension. This means that there would be effectively two or even three death taxes.

When addressing how an inherited 401k will be taxed when the death of the accountholder occurs there are three primary considerations. Not all taxation is theft. For the 2021 tax year the federal estate tax exemption was 1170 million and In the 2022 tax year its 1206 million.

Those states with a tax have a relatively high threshold before taxes are due. Assuming that 20 of these were too remote and therefore not affected by the pandemic that leaves over 500000 villages. Only a handful of states still collect an inheritance tax.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. In just about all cases the death benefits paid by insurance policies are free from income tax. The estate tax.

Death of a Person Receiving an IMRF Retirement Pension. If you take those distributions before you reach the age of 595 youll likely have to pay a 10 early withdrawal penalty fee to the IRS. A few states also levy estate taxes as well so you could get.

This situation occurs when the payout of death benefits is delayed. The estate tax is as the IRS puts it a tax on your right to transfer property at your death All the cash and property you own at. An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate.

In an attempt to stem this the Howard Jarvis Taxpayers. Any resulting capital gains are 50 taxable and added to all other income of the deceased on their final return where income tax will be calculated at the applicable personal income tax rates. No national estate tax while Australia Ireland and the United Kingdom tax capital gains transferred by gift.

While estate taxes seem to get all the publicity when it comes to taxes owed after someone dies the reality is that the majority of estates will not owe any federal estate taxes. The deceased owners estate would owe estate taxes if the total value of all their assets combined with the value of the IRA or 401 k exceeds the federal or state estate tax exemption for that year. Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal.

Although there is no federal tax on it inheritance is taxable in 6 states within the US.

While You May Have Already Done Your Taxes There Are Actions You Can Take Throughout The Year To Make Sure Th Entrepreneur Advice Business Advice Business Tax

Checklist What To Do When A Loved One Dies Edwards Group Llc Funeral Planning Checklist Funeral Planning Estate Planning Checklist

Rodney Ascher S New Doc The Nightmare Reveals The Real Life Horror Of Sleep Paralysis Shadow People Sleep Paralysis Shadow People Demons

How To Set Up A Trust In Wisconsin Estate Planning Checklist Setting Up A Trust Living Trust

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Brylaw Brylawaccounting Brylawaccountingfirm Accounting Incometax Tax Income Tax Tax Lawyer Quotes

It S Tax Day Have You Filed Your Taxes Yet As Margaret Mitchell Aptly Puts It There S No Convenient Time For Them Life Quotes Margaret Mitchell Quotations

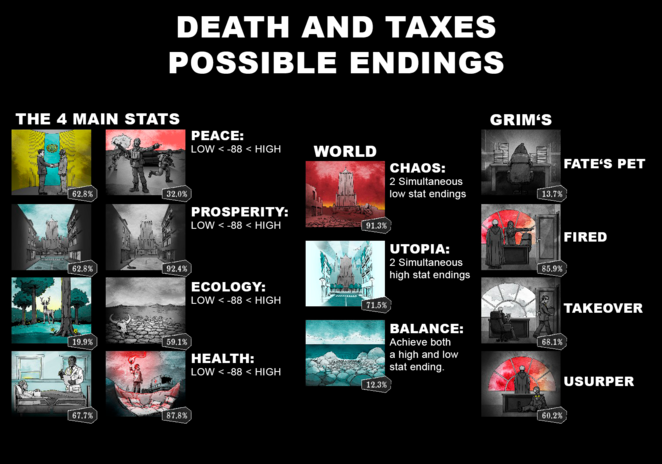

Death And Taxes Endings Guide Neoseeker

Can You Inherit A Tfsa Tax Free Moneysense

The Tax Professionals At H R Block Know How To Handle Any Tax Problem No Matter How Complicated There S No Tax Return They Cannot Hand Hr Block Tax Tax Return

Using Tax Records For Family History Research Join Crista Cowan As She Helps You Discover How Tax Records Family Genealogy Genealogy History Family History

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-6a117470967b4b49960be0fb69f474a4.jpg)